8 ways to maximise the value of CCR data

So you’ve decided to make the move to a fully CCR-enabled origination environment. You know how you’re going to tackle the process to implement, but now you’re thinking,

“What are we going to do with the data when we have it”?

It’s the logical next step and when you need begin planning your strategy to incorporate the new data.

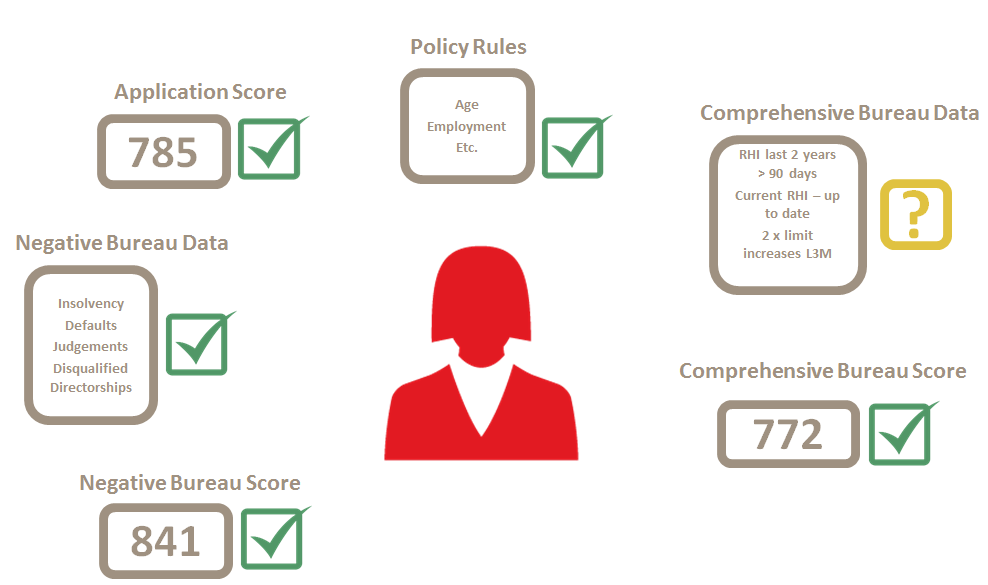

Below is a story that illustrates some of the difficulties that can arise when you begin to receive CCR data. CCR data is complex and can have an effect on many areas of the business. How would you deal with a situation whereby your existing credit assessment process is being disrupted by seemingly contradictory CCR information?

Here are eight tips to consider when deciding what to do with your CCR data:

1. Set a strategy first

First decide what you want to achieve.

Do you want to reduce the bad-rate while maintaining the current level of approvals or do you want to improve the approval rate but not at the expense of increasing bad-rate? Either way, implementation of an improved scoring model should help achieve these objectives.

2. Utilise the Equifax PreView analysis service

This service shows how data and scores would have been different under a comprehensive environment, and views the impact of the swap sets and approval rates.

With PreView you will receive a monthly file containing CCR-enhanced information, which you can then use to analyse the impact of CCR data on your current lending processes and self-validate the new comprehensive scores for selected portfolios.

3. Watch, wait and analyse

You can also do your review internally. One way to approach this is by maintaining the status quo for the time being and keeping all the new data for subsequent early analysis.

Using Equifax Apply, with its 3 score matrix report, means this strategy is easy to adopt.

4. Utilise a Champion/Challenger strategy

This approach asks you to base most of your decisions on the tried and tested approach (Champion), but make a portion of decisions using a new (Challenger) strategy and compare the two.

Depending on the risk appetite and objective, the Challenger strategy could be a major departure from the Champion strategy or only a small step away.

The idea is that Champion/Challenger becomes a regular process of continual implementation and analysis.

5. Re-evaluate negative bureau data

Negative data is still important. But how can you be sure you’ve been using it to best effect?

Credit providers typically short change themselves when they only look at previous defaults for weeding out prospective applicants, or lack of defaults for approving them. Many other factors should be taken into account. For example, enquiry patterns over time create a very predictive risk profile.

6. Try using your negative bureau score plus comprehensive refer rules

A relatively safe strategy involves implementing the new Equifax Apply Negative score with some referral rules based on CCR data.

Credit providers who have rejected the bureau scores before may find the new scores more beneficial. This is because the Good/Bad definition used in the new scores should be closer to your internal Good/Bad definitions as they use a “90 day overdue” status.

7. Use the comprehensive bureau scores from the outset

Equifax’s unique comprehensive bureau scorecards summarise very complex information into a simple scale which incorporates both negative and comprehensive bureau data.

In this new environment, simplifying the complex is more important than ever. This is because of the inherent complexity of comprehensive data making it almost impossible to pin additional decline or refer rules based on the data alone.

8. Validate your scores

However you decide to use your data, you must validate your scores.

A score validation exercise will mitigate some of the risks inherent in the use of pooled data to set strategies, and provide an understanding of the new score that will show:

- The relationship between score and your Good/Bad outcomes,

- The distribution of your applicant population across the full score range, and

- How the scores interact with other scores used by you.

Equifax score validation services are an option. Should you have any further questions or enquiries, please contact your Equifax account manager.